As we start a new year, most investors are still tallying gains, replaying mistakes, and wondering what 2026 might bring.

But Venture Traders are taking a different approach. We’re focused on the one thing that matters more than any forecast: the strategy that produces results across all market conditions.

Why? Because it’s working.

The first harvest is in. And the results tell a clear story.

TL;DR:

Process-based trading removes guesswork from investing decisions.

Venture Trader’s model portfolio gained 13.7% in its first quarter.

Every major benchmark lagged far behind.

This performance wasn’t luck — it was the result of defined rules and AI-driven selectivity.

The same process is planting seeds for a successful 2026.

3 Rules to Master in 2026

The most successful traders don’t focus on making money — they focus on building a process that makes money inevitable.

Frustration comes from the same root problem: trying to control outcomes that can’t be controlled. Individual trades are random. Markets are unpredictable.

And no strategy can reliably guess which trade will win or lose.

What can be controlled is the structure around those trades — the rules, expectations, and feedback loop that turn randomness into predictability.

There are three components every successful trading system must have:

Specific predictions (win rate, drawdown tolerance, annual return targets).

Rules to make those predictions true.

A feedback loop to confirm results match expectations.

Without those, traders drift. With them, traders compound.

The First Harvest: Proof the System Works

Head Quant Gordon’s end-of-year update put real numbers behind Coach Lincoln’s philosophy.

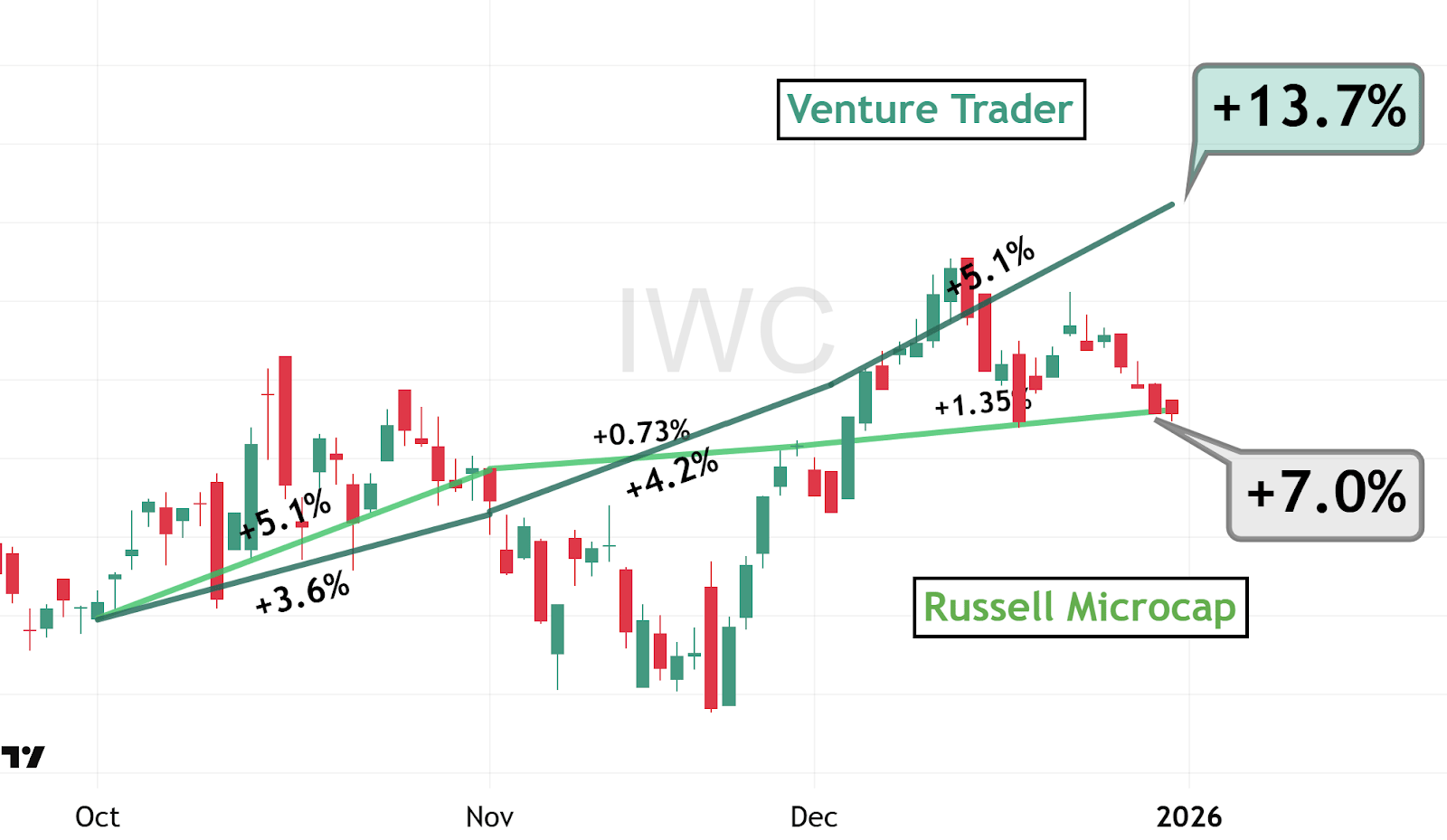

After just one quarter, Venture Trader’s model portfolio delivered a 13.7% gain — outperforming every relevant benchmark:

Russell 2000: 2.8%

Nasdaq 100: 2.2%

Russell Microcap Index: 7%

That gap isn’t noise. It’s signal.

Our results didn’t come from chasing hot sectors or riding sentiment.

It was the outcome of a system designed to operate where inefficiency still exists: small and microcap stocks overlooked by institutions and ignored by most retail investors.

Why AI Selectivity Matters More Than Ever

Superior returns don’t come from simply buying “small caps” as a category.

They come from selectivity — identifying which microcaps deserve capital and when.

Venture Trader’s machine-learning models analyze thousands of data points across fundamentals, technicals, and market structure to locate opportunities that human eyes — and Wall Street coverage — tend to miss.

This is why Venture Trader didn’t just participate in the quarter’s gains — it harvested them. And it’s why the team isn’t slowing down as the calendar flips.

Seasonal tailwinds, renewed risk appetite, and January’s historical strength in smaller names are already aligning with the same inefficiencies the models are built to exploit.

Wash, Rinse, Repeat!

Sustainable success doesn’t come from a few lucky trades — it comes from repeatable decisions made within a defined framework.

The Venture Trader results demonstrate exactly what happens when:

Risk is defined before entry.

Stops and targets create predictable win rates.

Trade frequency fuels compounding.

Results are measured against expectations, not emotions.

This is what Coach Lincoln calls the wash-rinse-repeat method of building real trading wealth — and why traders stop worrying about whether the next trade will work, and start focusing on whether the system is doing what it’s designed to do.

Be in the Room Next Week

Coach Lincoln and Gordon will be back live next Tuesday, January 13, at 4 p.m. ET to continue refining the process — and to share how Venture Trader is positioning for early-2026 opportunities.

If you want to understand why the system works — not just what it traded — this is the place to be.

If you want full access to every session, replay, our market research, and all AI-driven signals, learn more about our VIP Charter Membership here →