This week, the market is tiptoeing on thin ice.

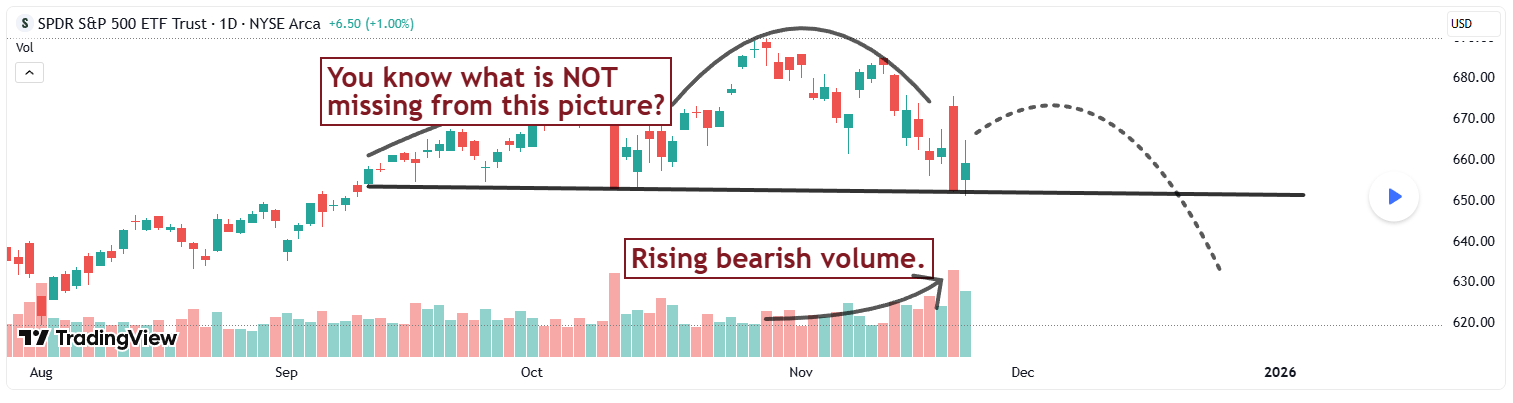

This chart shows where the ice is: the support level underneath the last two recent low prices since September.

If the market fails to make a new high but then makes a new low price by closing below the support level, that is a very troublesome signal for investors.

Such a signal would be a warning to 401(k) account balances, because a downward trend in SPY means most portfolios get smaller.

But Venture Traders will be living a different story.

Even if the small-cap index (the Russell 2000 as tracked by the stock ticker IWM), also trends lower, the careful Venture Trader signals can pick out high-probability profits along the way.

For more, be sure to tune in to our livestream tomorrow at 4 p.m. ET. And if you have any questions for Coach Lincoln or me, send them our way now at: [email protected].

Regards,

Gordon Scott

Head Quant, Venture Trader